Good news for property investors! Interest deductibility and Bright-line test changes coming soon

I’m sure most of you are aware that under the new government, mortgage interest deductibility is being phased back in. 80% of interest expenses are able to be claimed from 1st April 2024, and 100% from 1st April 2025. Read the full announcement from the Beehive.

The Bright-line test rules are changing on 1 July 2024, which means any income made from the sale of a residential property is only subject to income tax if sold within 2 years of acquiring the property. I try to remain politically neutral in these updates, however I really enjoyed this Herald article where Labour’s landlord data was proven to be severely lacking, so I’ll leave it here for you to read too, in case you missed it.

What’s happening to the rental and housing markets?

Interest rates

Looking at the six major banks, currently the lowest 6-month fixed mortgage interest rate is 7.29%. The OCR is currently at 5.5%, with the next announcement due on 10th April. There was chatter at the beginning of the year about the OCR coming down a fraction in 2024, but the latest statement from the Reserve Bank curtailed this, with most now expecting the OCR to remain flat for most of this year.

Inflation

The OCR is being kept high because inflation is still at 4.7%. This is much lower than it was (7.3% in June 2022), but the government has set a target of 1% – 3%, so monetary policy is still in a restrictive phase.

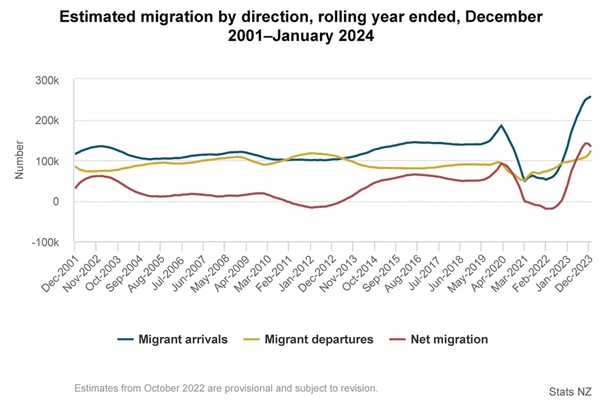

Net migration

This remains high, the latest data estimates from Stats NZ are shown in the graph below. Migrant arrivals are at an all-time high, and slightly higher migrant departures in January sees just a slight dip in net migration compared to the highest ever of 141,407 in November 2023. This increases demand in both the housing and the rental markets, but especially in the rental market as new arrivals most often rent a property before considering entering the housing market.

Supply

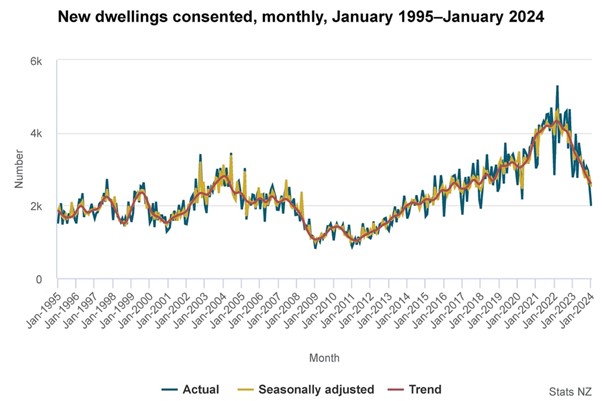

The number of new building consents is interesting data to look at when considering the housing and rental markets. Here are some key facts taken directly from Stats NZ :

- In January 2024, the seasonally adjusted number of new dwellings consented fell 8.8 percent, after rising 3.6 percent in December 2023.

- In the year ended January 2024, the actual number of new dwellings consented was 36,453, down 26 percent from the year ended January 2023.

- In the year ended January 2024, the number of new dwellings consented per 1,000 residents was 7.0, compared with 9.6 in the year ended January 2023.

So, what does all this mean for the housing market?

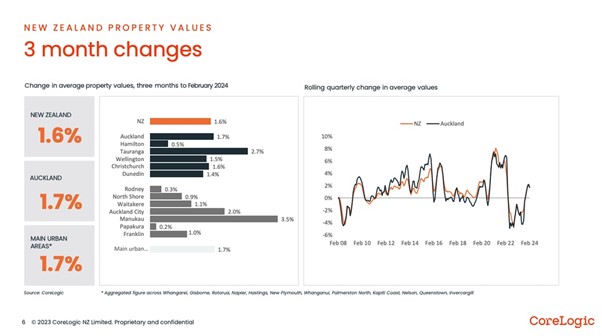

With housing supply slowing, coupled with increasing net migration, we would expect to see house prices, and rents, rising rapidly. But the housing market is also influenced by interest rates; and with the current rates of 7% and higher, the numbers often aren’t stacking up for investors or first home buyers to enter the market, or to expand their portfolio. House prices ARE now rising in most regions however; which I feel contradicts a lot of online discussion about high interest rates and new listings flooding the market. There are many articles pointing to sales listings being up and the number of buyers down. I encourage you to read this very interesting article by John Butt; he crunches the numbers and delves into the latest house price data; and he says prices are rising rapidly.

We are onboarding a lot of new customers at the moment who have tried and failed to sell their properties in the current market – so although the data says prices are rising; are potential buyers holding off for better interest rates or hoping for lower prices? Which means potentially the rising prices will only be short-lived? Will the Bright-line test changes mean more sales listings in July? Only time will tell what happens next! (Aspire’s MD, Mike Atkinson, believes house prices in Auckland will fall slightly over the next 4 – 6 months and are likely falling already. This is based on his experiences on the ground as a current house-hunter and auction-room attendee).

House price changes according to CoreLogic’s data:

What about the rental market?

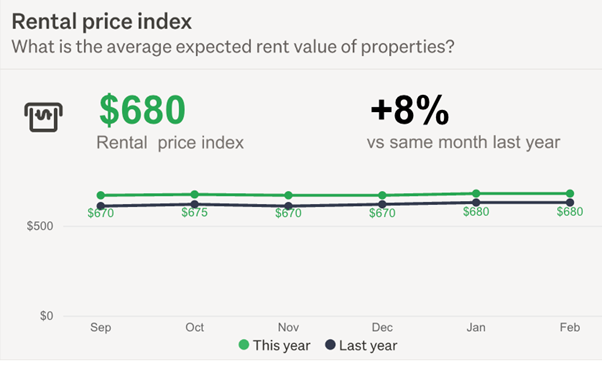

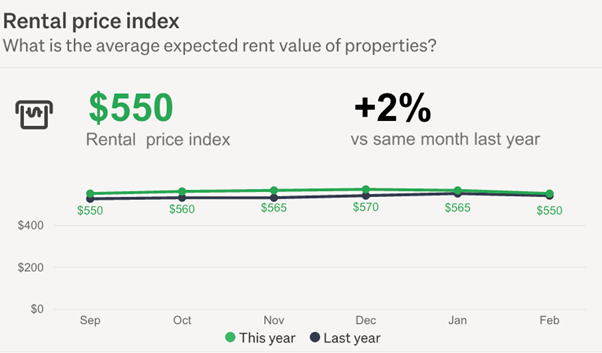

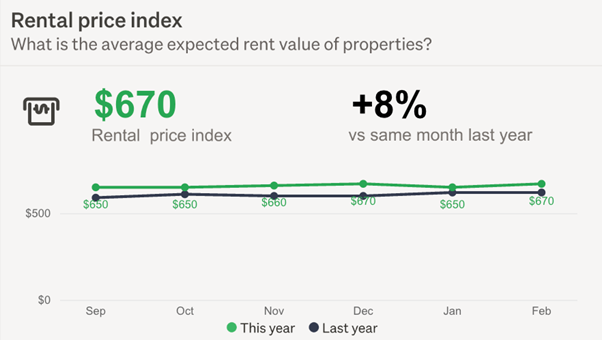

Trade Me are yet to release their February rental price index to the media, however I can see this information via our agents portal. Auckland’s median rent is up 8% year on year to $680, Waikato up 2% to $550 and Bay of Plenty up 8% to $670. Nationally, median rent is up to $640, a year on year increase of 7%.

Auckland

Waikato

Bay of Plenty

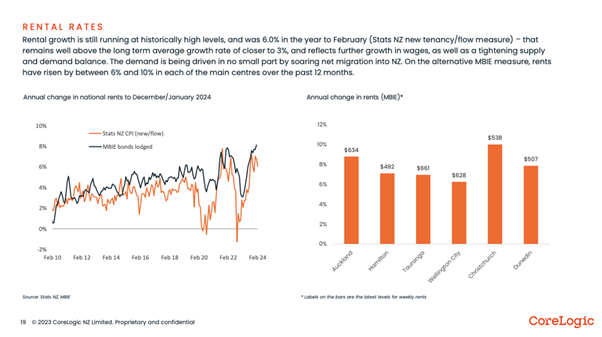

Here is the rental data from MBIE, presented by CoreLogic:

It’s important to note that MBIE and Trade Me are the two main data sources that news outlets and property managers quote when discussing market rent. However neither of them capture every rent that is currently being paid by renters across the country – they are data sources of new rents that are being paid. So both sets of data are interesting, but they are not a full data set of all rents paid in NZ, so not entirely accurate if talking about “rent” in general. For example; incumbent tenants are unlikely to have been met with an 8% rise in their rent in the last 12 months, if they are good tenants.

Whether it’s 2% or 8%; rent in NZ has continued to rise. Increasing costs for landlords are being passed onto tenants (healthy homes standards, high interest rates and increased costs of almost everything associated with owning a property); plus high net migration is increasing the demand for rentals – which all means rents are rising and are likely to keep rising for the time being.

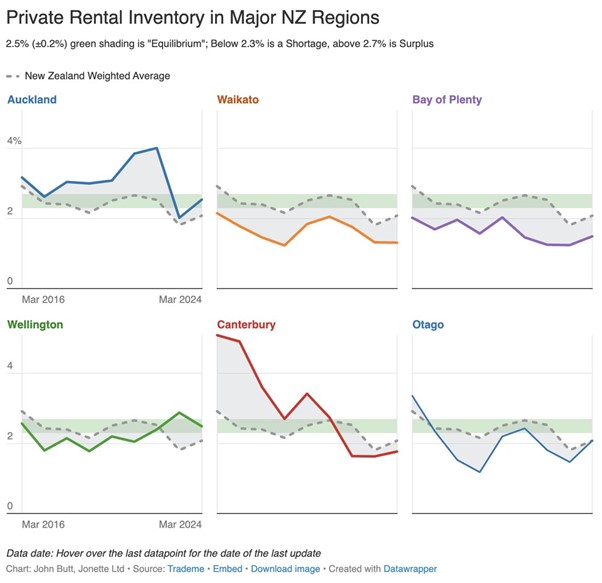

However – something to watch is rental supply in Auckland. According to rental inventory data that John Butt collates from Trade Me; Auckland supply is increasing, so we could be heading for a surplus soon. That blue line is at 2.54%, and according the graph, above 2.7% is a surplus of rentals.

What are we seeing at Aspire?

Over the last three months the range of rent increases we have suggested to owners with properties up for review, has been between 1.7% and 7.2%. Each suggestion is based on market research specific to that property; and is based on location, type of property, number of bedrooms and current demand in that area.

Looking at our Auckland data from 1 January 2024 until now, we have rented 73 properties, with an average number of days on the market of 16.5 (industry average 17 days) and a median rental price of $710. In the three months prior to this period (1st October – 31st December 2023) we rented 64 properties, with days on the market at 15.5 and a median rental price of $705.

In the last four weeks we have noticed viewer numbers and enquiries on listings declining in Auckland. This is mostly likely because January and February are very busy months, with lots of people moving around for the start of university, and many fixed term tenancies end in the summer months; and now things are returning to a more steady pace. But some of this will be because houses that are failing to sell are being returned to, or turned into, rentals; so rental supply in Auckland is increasing (as shown above on John’s Rental Inventory graph). We will be watching this closely and we’ll keep you updated if you are making decisions around fixed terms or periodic tenancies, or reviewing your rent.

If you’ve made it this far, thank you! Here is my quick summary (and this is my OPINION, based on my research and experience at Aspire, yours may differ!):

● House prices are rising, but look out for them to potentially fall slightly soon.

● Rents are rising currently, and will continue to do so, especially in the Waikato and Bay of Plenty, where there is a lack of supply.

● Rental supply is increasing in Auckland, look out for this to have an effect on Auckland rent prices – they may hold steady or even fall slightly for a period soon.

At Aspire we currently have 853 properties under management. We have 245 Google reviews and proudly score 4.9/5 – we believe this is the best score you’ll see for a property management company in NZ, so thank you to anyone who has left us a review, we really appreciate it! If you would like to review us you can do so here.

Justine Atkinson

Aspire Property Management