Big changes are ahead with the formation of the National/ACT/NZ First coalition government.

The timeline for the changes has yet to be clarified as the 100-day plan was announced last week, but none of the amendments that affect property investors was mentioned.

I have gone through the coalition documents and have taken these excerpts directly from them. These are the proposed policy changes that will be presented to Parliament that affect property investors and tenants:

- Restore mortgage interest deductibility for rental properties with a 60 per cent deduction in 2023/24, 80 per cent in 2024/25, and 100 per cent in 2025/26

- Allow landlords to issue a 90 day notice to a tenant to end a periodic tenancy without providing a reason or applying to the Tenancy Tribunal

- Return tenants’ notice period to 21 days and landlords’ to 42 if the tenant wished to move or landlord wished to sell a property

- Introduce “pet bonds” to make it easier for tenants to have pets in rental properties

The reinstatement of interest deductibility will have many investors breathing a sigh of relief.

The return of the no-cause or reason 90-day notice to end a tenancy is a big swing back in favour of landlords. This allows a landlord to end a periodic (or fixed, but only at the end of the term) tenancy without providing a reason or meeting any predefined criteria as you do under the current Act. The risk for landlords is ensuring you are not issuing these when tenants exercise their rights under the RTA, as you will still be open to a retaliatory notice claim. Commentators and industry advocates have tried to indicate that this is also a win for tenants by saying it allows landlords to give riskier tenants a chance, but this is a massive shift in the power balance back to landlords with no upside to tenants.

Pet bonds are a fantastic idea for both landlords and tenants. We often have tenants offering to pay a pet bond to help with their application, but it’s been unlawful to accept one – and I know of many property owners who will now be open to pets knowing they have the extra security of a pet bond. We hope the amendment goes further than just extending the bond for pets. We would like to see the RTA wording updated. The word “pet” does not currently appear in the RTA (apart from under boarding houses), and this ambiguity leads to landlords not feeling protected. Landlords will allow more pets if they are better protected, and the pet bonds are an excellent first step, but we are hoping for more.

Rental Market

According to CoreLogic data released last week, rental growth nationwide hit 6.1% in October, and it’s up to 8.5% in Auckland. Kelvin Davidson, NZ Chief Property Economist at CoreLogic, attributed this to wages growth and immigration. Similarly, Knight Frank released data showing that Auckland has had prime rental growth in Q3 2023; third in the world only to Singapore and Sydney.

Mike Hosking approached Aspire’s MD Mike Atkinson for comment; listen to his interview on ZB’s Breakfast Show for all the details.

Kate Hawkesby was also keen to talk to Mike Atkinson about rental growth on one of her last ever Early Editions.

According to CoreLogic:

- Nationally, rental growth hit 6.1% in October, reflecting higher wages, but also a tightening supply and demand balance, as migration soars in NZ.

- Gross rental yields nationally have edged back up to 3.2% (from a trough of 2.6% for much of 2022), the highest level since late 2020.

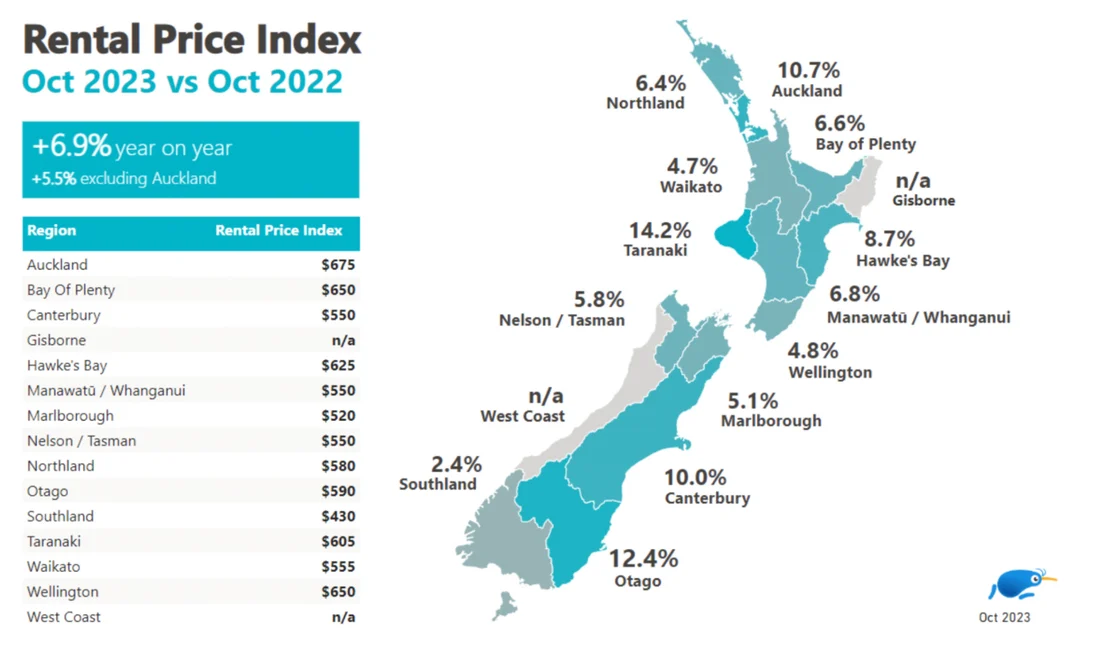

According to TradeMe’s latest rental data; national rents are up 6.9% year on year as of October; with Auckland at 10.7%, Waikato at 4.7% and Bay of Plenty at 6.6%.

Net migration

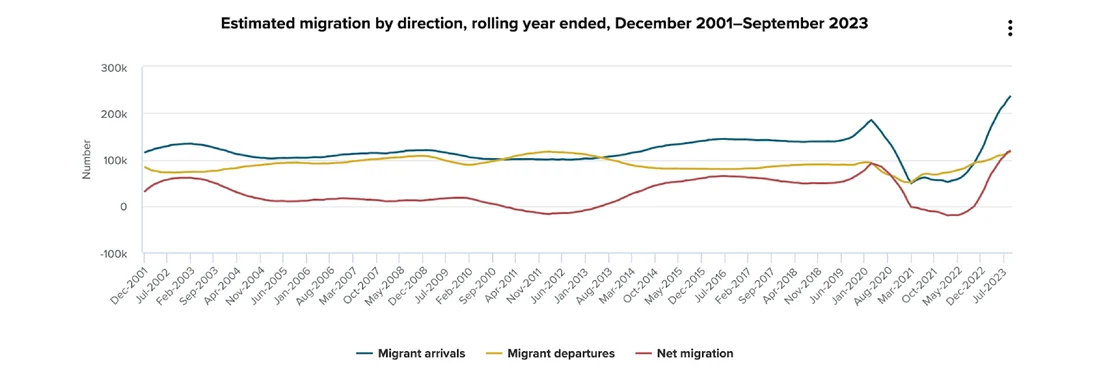

A key driver of the rental price growth is increasing demand for rentals, driven by positive net migration. You’ll recall that pre-Covid immigration was going strong, and now it’s back at higher levels than before Covid. According to Stats NZ, annual net migration reached the highest level ever on record in Sept 2023 (118,835).

What’s happening at Aspire?

The data is saying Auckland rents are up somewhere between 8.5% and 10.7%, depending on your data source – however during our rent reviews, the rent increases we are seeing aren’t quite as high as this in most cases. My feeling is that Auckland is showing so high in the aggregate data because of the dramatic swings in the apartment rental market. During Covid and beyond, apartment rents decreased dramatically. We had some in the CBD of Auckland that went down 35% to attract tenants in a very depressed market. Now the apartment market is returning to pre-Covid levels with strong immigration and the return of students. So if your property is a house in the suburbs, you will be seeing rental increases that won’t be as large as if you owned an apartment in the CBD. Our apartment rents have gone up an average of 14% since the start of 2023.

Demand is high for rentals, with enquiries coming through thick and fast on new listings. The industry average for days on the market is currently 18, and we were at 15.5 days for November; so properties are being rented out quickly, even with increasing rental prices. This year we have rented out 249 properties, conducted 987 viewings and shown 4,484 groups of people through properties – a very busy year!

80% of our properties that have had a rent review in the last 3 months have had their rent increased by between 2.5% and 8%. Apartments have had higher rent rises, the highest being 17%. Rents across all properties and locations are generally rising, however everything is always done on a case-by-case basis, so your property manager will conduct a full market review for your property and advise the best approach when it comes time to review your rent. We find that some owners with good incumbent tenants are reluctant to increase the rent to the levels that we recommend. This is a tricky one, as you might not be getting the market rent you could be; but we understand that you might not want to risk a vacant property if your tenant decides to leave when you increase the rent. We respect that the rent you charge your tenants is your decision, but we will always make recommendations to maximise your rental returns.

We have also launched our new website that will make it easier for people to find out more about Aspire. There is a Resources section especially for property owners where you’ll be able to find articles about anything to do with property investing and any relevant updates from Aspire.

We proudly have 785 properties under management. We have 229 Google reviews and score 4.9/5 – we believe this is the best score you’ll see for a property management company in NZ. Join us today and find out why our customers are so happy!