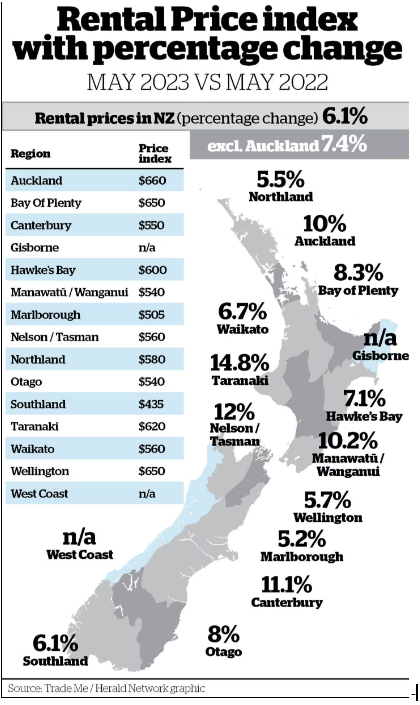

Rents are on the rise again. After a period of rental price stability in late 2022, rent is now increasing in most categories of housing and suburbs. According to the latest Trade Me data, the median weekly rent in Auckland has risen to a new record high of $660 per week, which is a 10% increase from 12-months prior (May 2022 – May 2023). Median weekly rent on average for the Waikato region has increased 6.7% and Bay of Plenty 8.3%.

Why are rents increasing?

Lack of supply.

There is a shortage of rentals, especially in the Auckland region where the floods have taken some rental stock out of the market. According to Trade Me, supply is down 35% year on year, while demand is up 55%.

We are expecting this dip in supply to partially correct itself over the next 6 months as flood-affected properties are repaired and come back on the market.

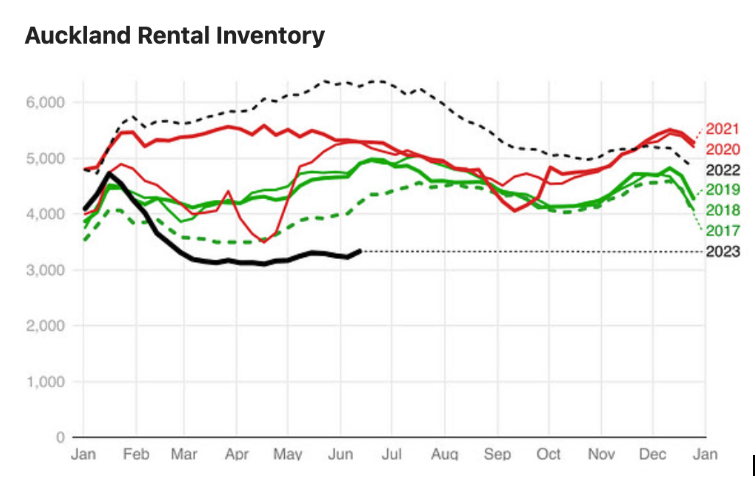

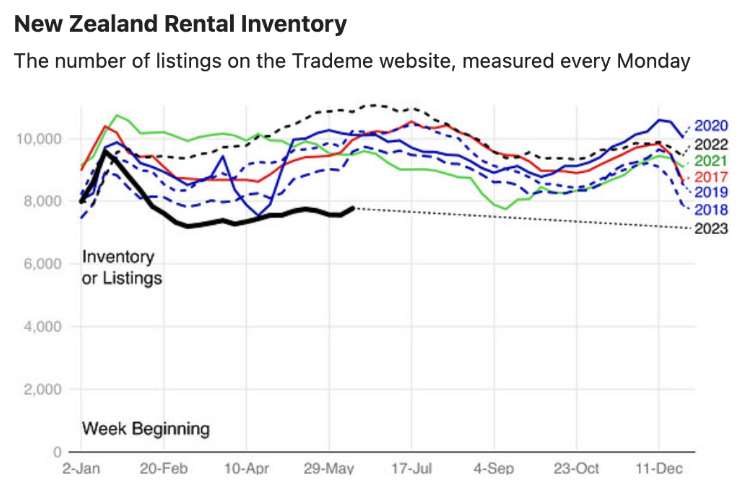

John Butt from NZ Property Information has provided this interesting data regarding Trade Me listings, you can sign up to read his newsletters here.

Auckland inventory is extremely low at about 3,200 compared to a normal activity of around 5,000.

New Zealand inventory is very low in historical terms, early June is usually around 10,000 homes advertised, this June there were only around 8,000.

Government policy/High inflation/High interest rates.

Government tax policies and a higher OCR/rising interest rates, are increasing the costs of owning investment properties, so this continues to drive rents up.

Inflation is still not under control, so we will possibly see the Reserve Bank continue to increase the OCR, time will tell. The latest inflation data from Stats NZ is that we are at 6.7% as of March 2023, which is down from 7.2% – but that’s a long way off target inflation of between 1% and 3%.

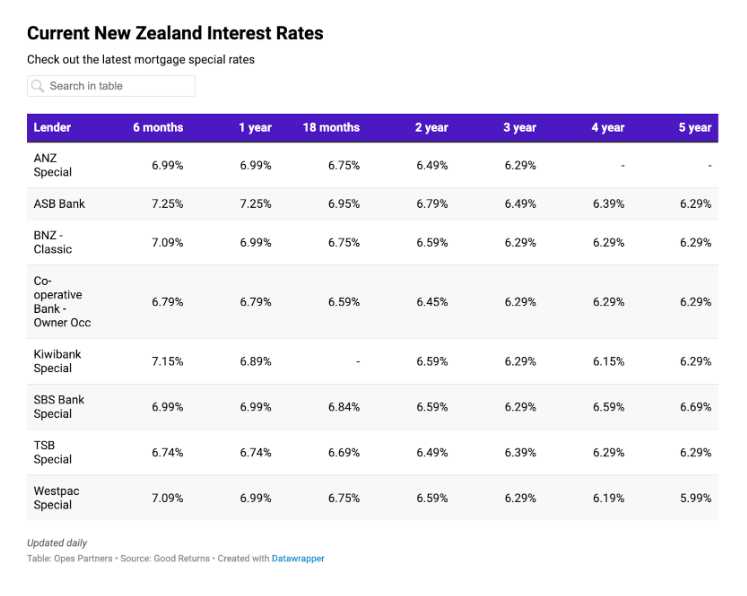

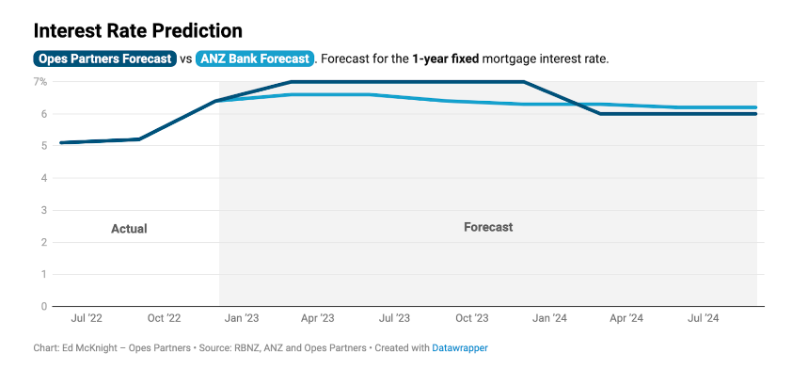

Here are the current NZ interest rates thanks to Opes Partners:

And here is their prediction for interest rates:

Higher interest rates look like they are here to stay for at least the medium term, which will keep the cost of owning investment properties higher, so rents will continue to rise, unless there is a change in demand, or government policy around interest deductibility.

Demand is increasing.

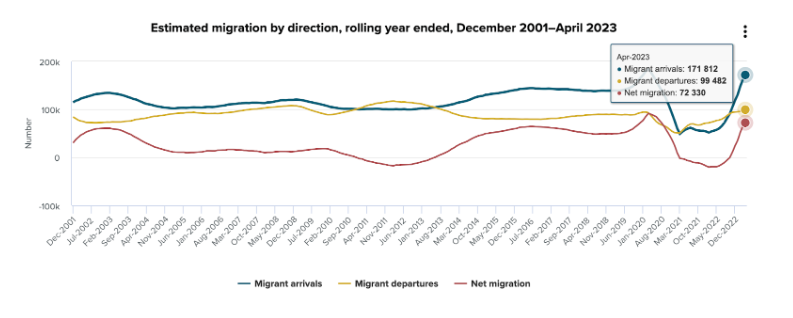

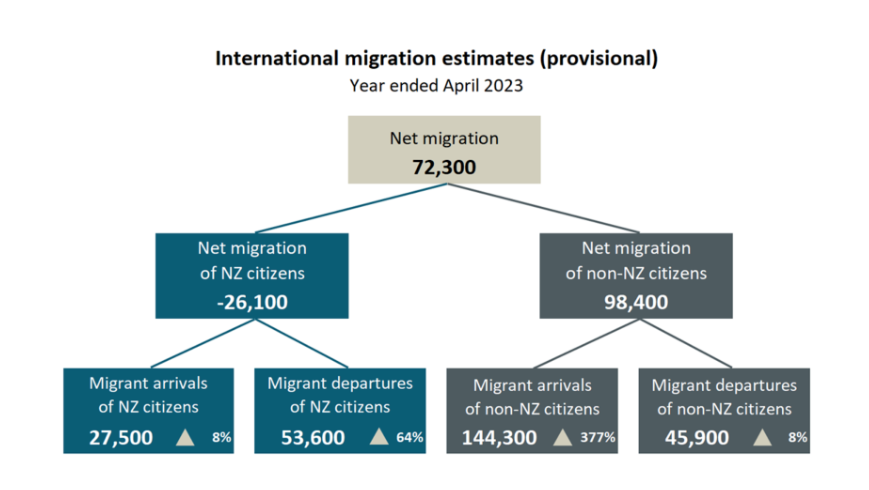

Net migration is positive again, so demand for rentals is on the rise. The latest data available from Stats NZ has April 2023 net migration at +72,330, which isn’t too far off where it was pre-Covid (a peak of 91,680 in March 2020).

We can see above that New Zealanders are leaving to live or travel overseas, which could see rental stock increasing as they turn their homes into rental properties or they move out of their rental; but this is offset by the larger net migration figure of non-NZ citizens travelling or moving here to live; these people increase the the demand for rentals as they are more likely to be looking for rentals instead of purchasing homes.

What’s happening at Aspire?

We are seeing strong turnouts to viewings in Auckland, the Waikato and the Bay of Plenty, and the average time each available property is spending on the market is only 15 days. In March 2023 our time on the market was 23 days, and in May last year it was also 23 days. The current industry average is 18 days – which is down from 25 days at the same time last year. We attribute this shorter time on the market to two things; first the rental market is heated, and secondly we have increased the resources in the lettings team.

Auckland CBD properties are in hot demand with the increase in international arrivals. Waikato and Bay of Plenty properties are very popular with huge turn-outs to viewings.

Across our whole portfolio, Q2 viewing numbers are up 28% on Q1 numbers (and they were up 35% on Q4 last year).

This month, we are celebrating a milestone of reaching 750 properties under management, and we are expanding our staff to keep up with demand. We thank our existing customers for their continued support, and we look forward to welcoming you as a new customer if you haven’t joined us yet! Contact us now to get the ball rolling.