Rental prices have decreased for the first time since 2022.

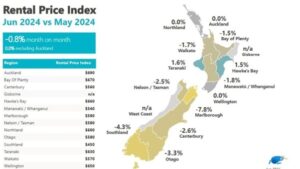

The latest Trade Me rental price data was released to the media on 25th July, and they are leading with headlines similar to the above. While true in the regions, rent currently remains flat in Auckland. They are looking at month-on-month data for their articles; the positive news is that rent in Auckland and the Bay of Plenty is still 5% higher than this time last year, and in the Waikato, it’s 4% higher. Auckland rental prices have remained steady month-on-month from May to June, with no change in average weekly rent. Waikato sees a drop of 1.7% and Bay of Plenty 1.5%. Read the Stuff article and the Trade Me article here.

However, given the number of properties available for rent and the number of potential tenants attending viewings, Auckland rents will most likely begin to fall slightly over the coming months.

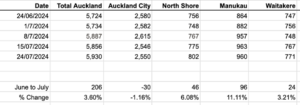

Rental prices June 2023 vs June 2024

Auckland

Bay of Plenty

Waikato

Why has rental-price growth changed?

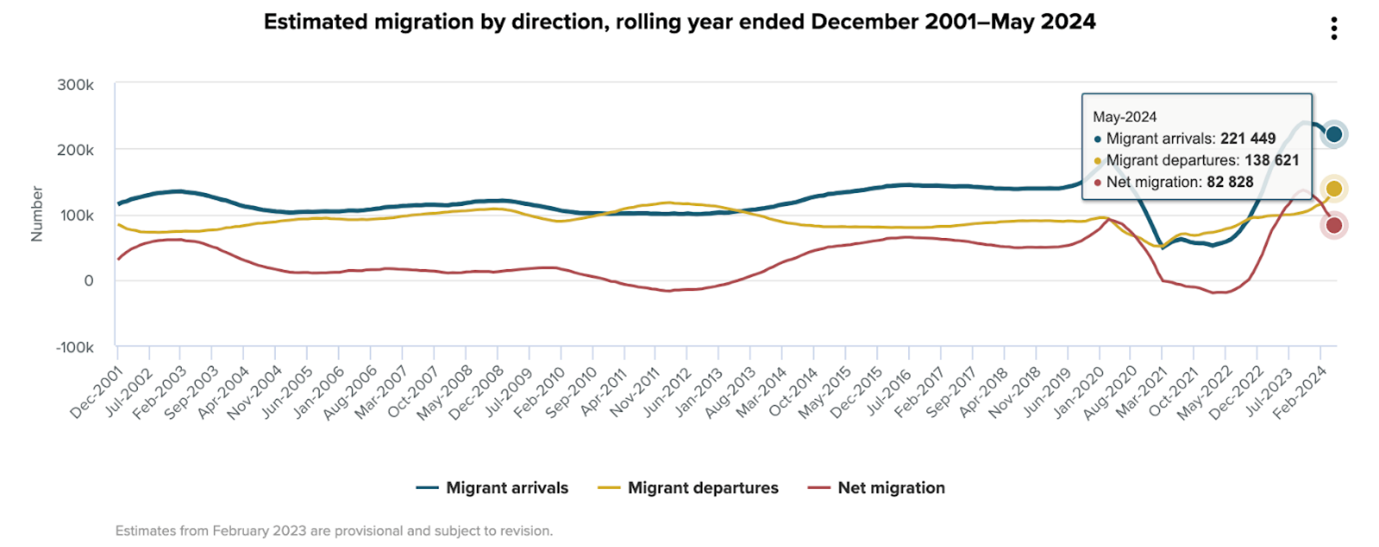

Immigration

The number of migrant departures for May 2024 is the highest annual number on record – Kiwis are leaving in search of opportunities overseas, so their house becomes available to rent. Net migration is still positive – so there are still more people arriving than there are leaving; however, demand for rentals is slower than a positive net migration figure would indicate, so perhaps some migrants are living with family in existing properties, or more people are going into each rental. You can see in this graph from Stats NZ that net migration peaked in October 2023, and since then, it’s been in decline.

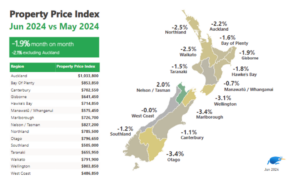

Housing market

With house prices falling and houses failing to sell, many owners are turning them into rentals. At Aspire, we have had eight customers join us in the last four weeks with a house they were trying to sell, and now they are keeping it and renting it out.

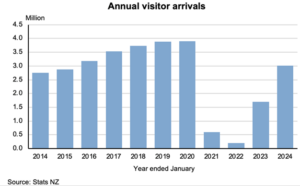

Short term rentals

I can’t find data to support this theory, but are owners turning their short-term rentals back into long-term rentals in these uncertain times to ensure a steady income? We can see rental stock increasing significantly, indicating this is happening. You can see that while tourists are coming back, they aren’t up to the pre-Covid levels yet.

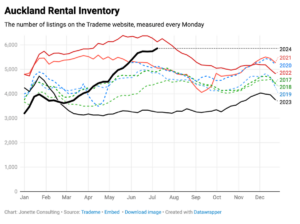

Rental Listings Continue to Climb

We track the weekly Trade Me listing numbers across Auckland. The listing numbers have increased by 3.60% in the last 30 days (and 81% in 12 months).

John Butt from Property Information NZ has been tracking the data for many years. You can see a vast difference between the number of rentals available now and rentals available at the same time last year. As of 8 July 2024, 5,887 properties were available to rent in Auckland, compared to 3,245 on 8 July 2023. That’s an increase of 81% in just 12 months. There are also inventory increases in the Waikato (20%) and Bay of Plenty (67%).

Please note that in Trade Me’s media release, they said that rental inventory has increased by 23% nationwide. The data we have says it’s increased by 56%. Quite a difference – I have reached out to them for comment, and if they get back to me I will publish their response in this article.

What’s happening at Aspire Property Management?

Viewing and enquiry numbers are down

We are working hard to rent all vacant properties —the biggest challenge is getting people to come through the door. Potential tenants have far more choice than they did last time they were looking for a property, and we are seeing many viewings cancelled because no one has booked in to view.

In June 2023, we listed 31 properties to rent on Trade Me and received 2,438 enquiries about them. In June 2024, we listed 38 properties and had 1,458 enquiries—so that’s 40% fewer enquiries while having 23% more properties available. Or an average of 78 enquiries per property in June 2023 vs 38 per property in June 2024 (a decrease in the enquiry rate of 51%).

Days on the market

Our average “days on the market” for a vacant property is 19, up from 16 in June 2023. The great news is that with Aspire, your vacant property will rent much faster than with our competition, as the market “days on the market” is 22 (this graphic is thanks to Nicole Gillies at Trade Me).

We proudly manage 900 properties. We have 272 Google reviews and a score of 4.9/5—we believe this is the best score for a property management company of this size in New Zealand.

If you would like to join Aspire, contact us now!