The recent weather events in the North Island have provided big challenges for affected tenants and landlords. Tenants have needed to find new homes and landlords have been left with big repair jobs and uninhabitable properties. Before the floods and the cyclone we were seeing a small upturn in the rental market, and these events have expedited a return to rising rents in some categories of housing and suburbs.

According to Trade Me’s data, the last quarter of 2022 saw rental prices remain flat – however now they are increasing again and, according to Trade Me’s Gavin Lloyd, the median national weekly rent is $580, the highest it has ever been. Trade Me’s data also points to rent increases in every region except Wellington.

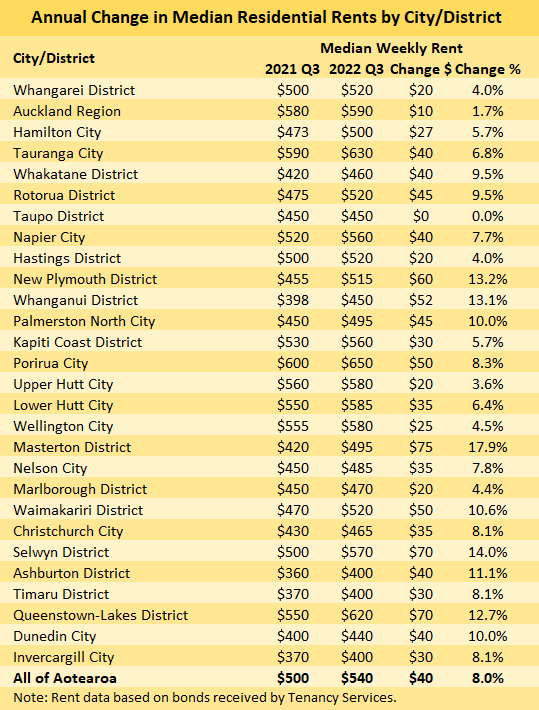

However this data is amalgamated across every building type, number of bedrooms and suburbs. If we look at the data from MBIE, which looks at bonds lodged and rent paid, the rent changes vary widely across these classes. For example, YOY rent as of Jan in Orewa for 3-bedroom properties is up 4%. But it’s down 4% for 1-bedroom properties. You can access the full MBIE data here.

MBIE and Trade Me are the two main data sources that news outlets and property managers quote when discussing market rent. However neither of them capture every rent that is currently being paid by renters across the country – they are data sources of new rents that are being paid. So both sets of data are interesting, but we shouldn’t make generalisations about rent just based on these.

At Aspire we treat every rent review on a case-by-case basis. In 80% of cases right now we are recommending rent increases of between 1.5% – 6%, but in some cases it’s not the right course of action. We base this advice on many different factors, including attendee numbers at viewings in each suburb and for each number of bedrooms, enquiry numbers, number of days properties are taking to rent, migration data, plus the Trade Me and MBIE data.

What are we seeing at Aspire?

Immediately following the floods we saw an influx of potential tenants attending viewings, and most of the 17 houses we had available for rent were snapped up quickly. The average time properties are taking to rent is much less than it was 6 months ago – right now it’s 25 days, back in August it was 37 days.

The number of people turning up to view properties has increased by 35% in Q1 (Jan – Mar) compared to Q4 (Oct – Dec) last year.

3 and 4 bedroom properties remain the most popular in terms of the number of interested parties attending viewings.

Auckland CBD apartments went through a tough patch after Covid saw the international students and travellers disappear. It’s been great to see this market is recovering and CBD apartments are currently renting more easily now.

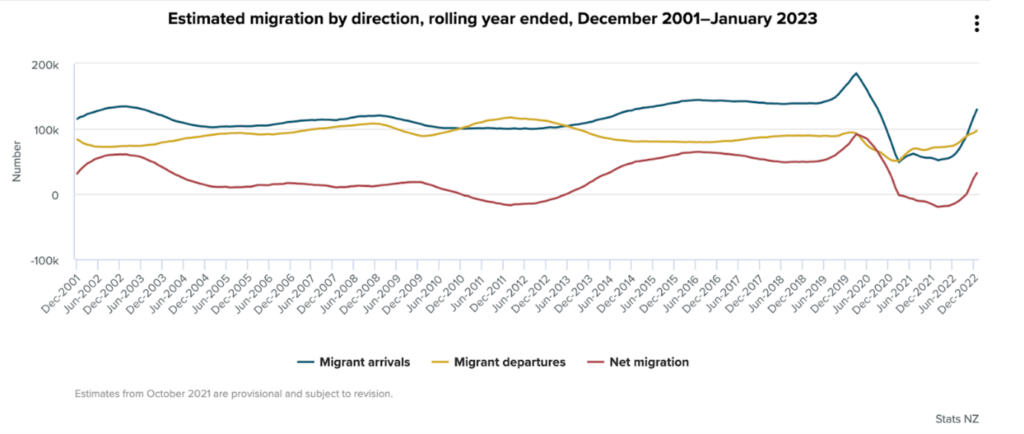

Net migration

According to Stats NZ, net migration for Jan 2023 was +33,200 – a welcome change compared to Jan 2022 which saw a net loss of 17,500. A return to positive net migration is excellent news for landlords and a trend that will hopefully continue throughout 2023.

Read more here: https://www.stats.govt.nz/information-releases/international-migration-january-2023/

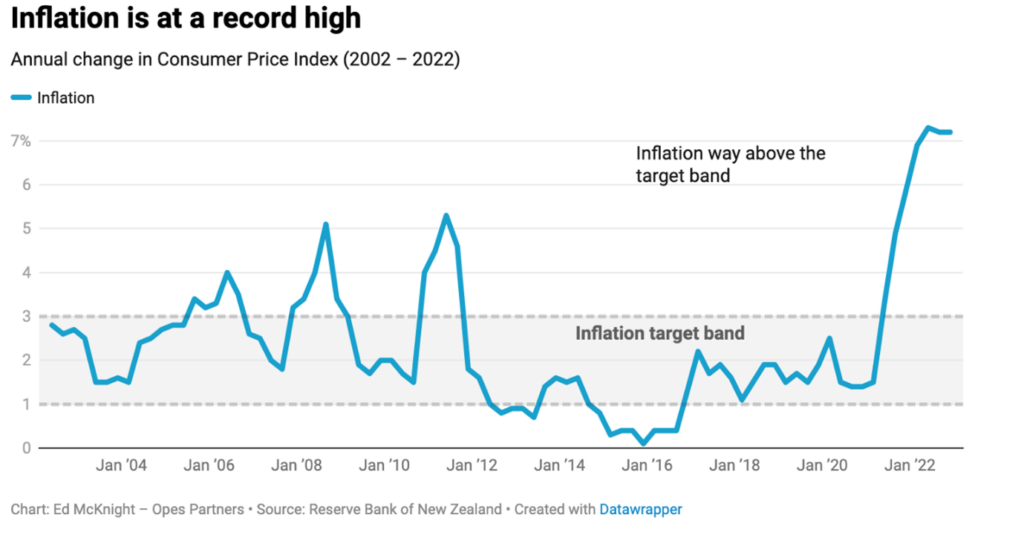

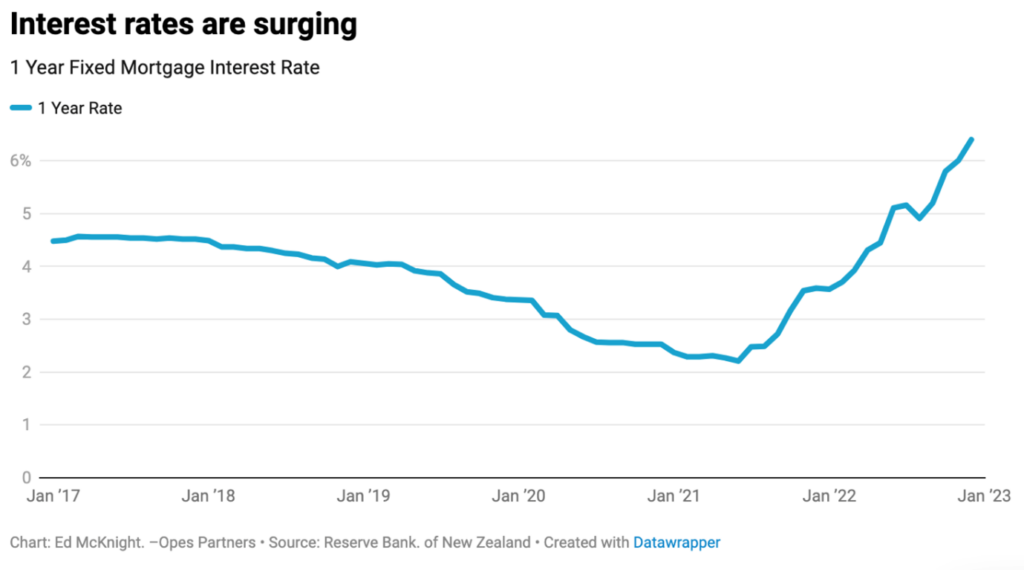

Inflation and interest rates

The inflation rate stands at 7.2%, and with the increase in interest rates on mortgages, the expenses of property ownership have escalated. Usually you would see an increase in rent, however rental supply and demand are additional factors that influence rent prices. While rising inflation and interest rates typically drive rents up, it is uncertain how large future increases might be, as other factors also play a crucial role.

Housing supply

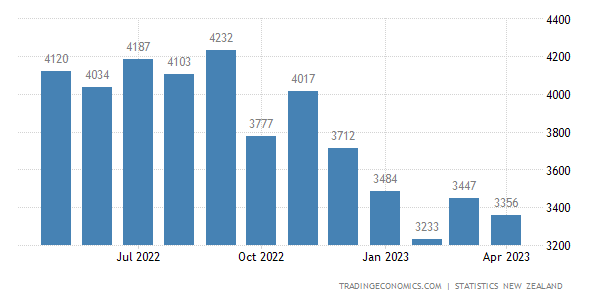

Last year we saw rental stock being added to the market quickly with new builds being completed, and houses failing to sell and being turned into rentals. According to REINZ the number of days that houses are taking to sell right now is 60. This is the highest since 2015, and it’s affecting rental supply by having a large number of houses out of the rental market while they are being sold. New builds and developments have also slowed down. According to Stats NZ, new building permits granted each month are declining and are down 19% since the peak of 4,567 in March 2022. In Jan there were 3,700 new permits issued. These factors will be playing a role in driving rents up again.

Where to from here?

Overall the rental market is improving for landlords, and the factors that affect rent are indicating that rents will continue to rise in the foreseeable future. This doesn’t mean that you should rush to increase your rent however, as you may want to encourage good tenants to stay by leaving your rent the same, or your property may fall into a category or suburb that isn’t seeing rent increases.

Contact us if you have any questions!